The new tax law, commonly called the “Tax Cuts and Jobs Act,” is the biggest federal tax law change in over 30 years. The following information summarizes a small portion of this recently enacted legislation. It is important to recognize that every individual and business are under different circumstances and thus will be affected in different ways. Therefore, it is vital to consult with your certified public accountant to ensure that you are taking every opportunity to maximize the benefits while mitigating the pitfalls.

*Except where noted, changes are effective for tax years beginning after December 31, 2017. Any suspended provisions are effective through 2025.

Opportunities for individuals:

Challenges for individuals:

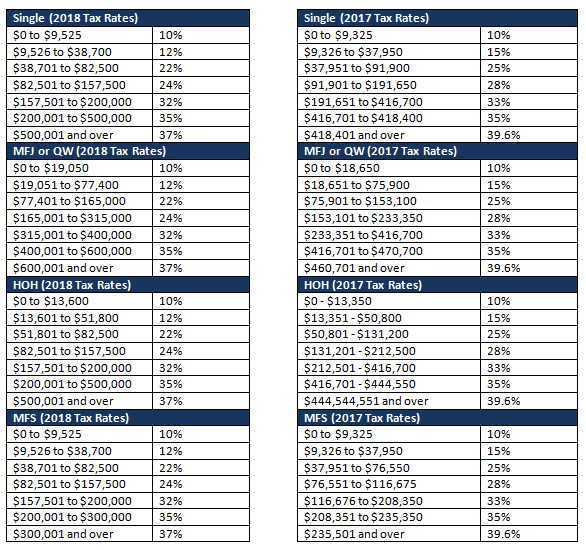

The following charts compare prior tax rates, brackets, phase outs and deductions with newly enacted legislation beginning in 2018.

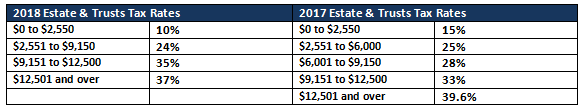

The Estate and Trusts Income Tax Rates have been revised as well. These changes are as follows:

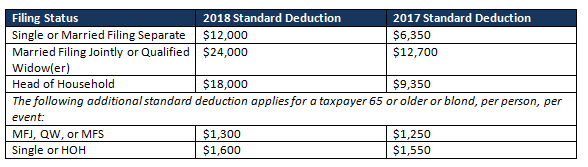

The Standard Deduction has been increased substantially. These changes are as follows:

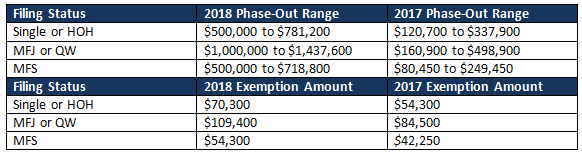

The 2018 alternative minimum tax (AMT) exemption and phase-out ranges have also been increased, greatly reducing the number of taxpayers affected by it. These changes are illustrated here:

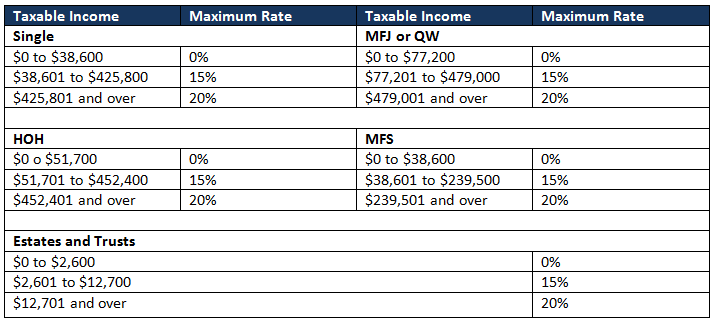

The long-term capital gain and qualified dividend income maximum tax brackets no longer follow the tax brackets for regular income tax purposes.

The parent’s rate is no longer used to calculate the kiddie tax. Instead, taxable income attributable to net unearned income is taxed at the estates and trusts tax rates for both ordinary income and net capital gains.

The Tax Cuts and Jobs Act has opened the door for all new planning opportunities that when proactively administered, can save small business owners a substantial amount of personal income tax. The following is just a broad overview of some of the recent changes.